Global health events. Trade wars and tariffs. Political discord. Rising foreign labor costs.

External factors such as these have had a major impact on U.S. manufacturing. Many companies were challenged in 2020 just to complete ordinary day-to-day production tasks due to supply chain disruptions. In fact, a National Association of Manufacturers survey reported that 59.5% of respondents experienced supply chain problems in the first half of 2020.

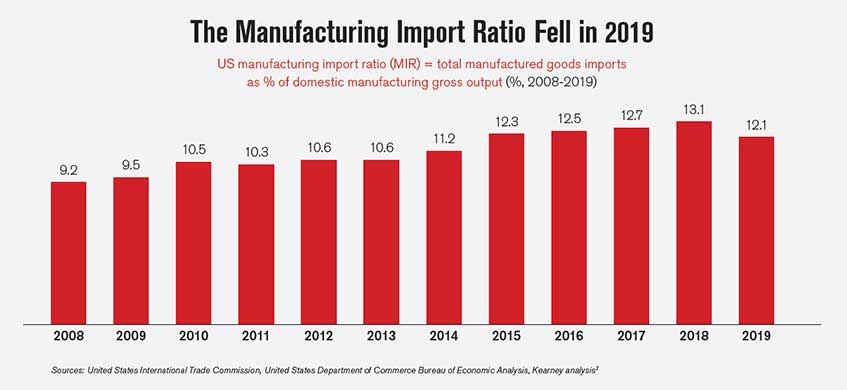

That being said, COVID-19 simply put an exclamation point on trends that were surfacing prior to the pandemic. For example, a pivot away from sourcing goods from China was already underway as a response to the trade war. According to the Kearney U.S. Reshoring Index, a dramatic shift occurred in 2019, when the U.S. manufacturing import ratio (MIR) contracted a little over 7%, the first decline since 2011.2 Kearney attributes the decline to a collapse in imports due to the trade war with China.

These shifts indicate that the manufacturing landscape is in fact changing. After a steady 40-year decline, the United States is on the precipice of a new chapter. As more manufacturers continue to minimize their reliance on global supplies and, moreover, the industry looks to rebuild the domestic manufacturing sector, it is expected manufacturers will accelerate reshoring and nearshoring activities. In fact, a Thomas Industrial Survey reported that more than 60% of the manufacturers and suppliers surveyed said they are likely to return operations to North America.

Although a return to domestic manufacturing is gaining momentum, it is not without its challenges. If these challenges are not pre-emptively addressed, they will undermine a company’s ability to realize domestic growth. Here are three aspects of domestic production that U.S. manufacturers must consider to position their operations for long-term, sustainable growth.

Establishing new sourcing protocols does not necessarily need to be an all-or-nothing approach. Some manufacturers may find that a blended approach is the best path forward.

Here are three examples why reshoring should not be pursued in a vacuum:

Although job losses interfered with that projection in the short-term, rebuilding manufacturing in the U.S. became a ubiquitous battle cry for post-pandemic economic recovery. Every manufacturer who wants to grow the bottom line must adapt operations to reduce manual labor and create production efficiencies. Exploring how automated systems will reduce downtime and increase throughput will be a pathway toward sustainable growth.

Driven by the demand for lower-price products, cost has been the primary driver for outsourcing production and seeking materials from global suppliers since the 1980s. Due to the rising costs and instability of global outsourcing, domestic manufacturing is poised for significant growth. While policies and incentives will certainly contribute to successful reshoring efforts, manufacturers also need to take steps to prepare their operation for a competitive future in North America.